BB has been an advantage play community since 2015 and in the decade before this we were involved with various betting syndicates. Through our experiences with the more professional teams we identified four dark arts that each of them worked on to maintain their profitability.

Some bettors are more proficient at one skillset than others, but without putting effort into each of these arts then it you may end up quitting – landing on that dumpster pile where too many failed professional bettors have ended up before.

The Dark Arts are:

- Edge Identification

- Getting On

- Staking Optimally

- Psychological Management

Edge Identification

We need to be clear on how and why we are beating the markets.

You fancy Man United tonight?

You think there will be cards in the Rangers game?

Whats your expectancy? Your probability distribution? Your historical regression? Tell me how are you are beating the market and why are you beating the market from mathematical principles. If you can’t answer these questions clearly and concisely then you should stay away from the term “professional” and stick with the twitter boom-boys (flame flame flame).

At bookiebashing we identified 5 edges that we wanted to focus on. There are more, but these are the edges that we felt we had the ability to profit sustainably within a wider community:

- Each Way Betting

- Pricing up from first principles

- Steamers

- Biased Markets

- Concessions

Each Way Betting

We are fortunate to be presented with fixed each way betting in the UK. Bookmakers fix the place odds of a bet to the win price at 1/4 or 1/5 or some other fraction.

Very few markets exist where the probability of each place position is fixed linearly to the probability of the win price.

With the roll of a dice – the probability of rolling a six within n rolls is directly related to the number of rolls of the dice we have. We can mathematically determine the probability of rolling a six in 3 rolls (a place price) that is fixed to the probability of rolling a six in 1 roll (a win price).

With sports teams, golfers or a horse we cannot attach the same relationship to them achieving a 2nd, 3rd or 10th place.

Given that the win price of an each way bet is rarely value this means that we can profit from each way betting if we can identify where the place is priced up high enough to overcome any loss from the win. A simple example of this that most people will be aware of is the filthy each way horse race – where a short priced favourite will result in value in the place part of longer priced horses. However value can also be found in markets from ante-post football and golf to Eurovision.

To determine the value in each way betting we need to be able to price the Win and Place components of each bet independently of the bookmaker. By comparing the bookmakers prices to our prices we can then identify value.

Pricing up from first principles

A lot of benchmarking comes from the comparison of prices against an exchange or other source (top price, spread betting firms etc.).

The problem with this benchmarking is we may want to

(1) profit from those exact markets, and

(2) those markets can themselves be biased, or wrong.

We can only determine value in them if we price up markets ourselves from first principles.

Pricing events up isn’t as difficult as it sounds. We need a reliable data source and a relevant probability distribtion, We know that the odds of rolling a (1) or (2) on an unbiased dice are 2/6 = 0.3333. We can convert that into decimal odds by simply taking the recipricoal (1/0.333 = 3.0).

In sports we don’t have probabilities that are as clear cut as an unbiased dice – but we do have a set of means (or averages) that we can use to work out an expectation. We can work out the expectation of a team to score, a corner to be taken, a card to be shown or a time for a 100m sprinter to run based on previous efforts and similar situations. From this expectation we can then apply a probability distribution such as Poisson. This can be adjusted to account for bias such as 0-0 bias or the clustering of corners.

Some often use the argument that “you can’t price up markets any better than the bookmakers or market makers because they have access to better data than you”. This is short sighted and unimaginative. If the bookmakers or markets have access to better historical data and modelling than we do – then why not use information from the bookmakers or markets to work out what expectation they have used? This information can then be applied to secondary markets in which we can find an edge. We use the markets to beat the markets!

A simple example of this is comparing an efficient under 1.5 market with correct scores 0-0, 1-0 and 0-1. If we assume one of these markets has to be efficient and the probability of under 1.5 goals does not equal 0-0 + 1-0 + 0-1 then there is value somewhere. The game becomes figuring out which market the value is in and this is why we need the ability to price things up ourselves.

Another method for pricing up markets is by using a historical regression. Can we find trends in a large data-set? Can we find trends with a decent r-squared (fit)? An example at bookiebashing is the BBAlgo in horse racing. We looked at 2 million horses over races over 20 years to come up with probabilities for horses finishing in 6th, 7th, 8th, 9th positions etc. Are those probabilities exactly precise? No, not exactly. Are they good enough to beat the markets in the long run? Absolutely, and we have document enough proof of this through our results page.

Biased Markets

Biased markets can take a number of different forms. We have fav-longshot bias, where the bookmakers apply more markup to longer odds due to the psychological anomaly that staking larger amounts of money is less appealing, even when staking to the same liability. Its much easier to stake £10 at 100/1 than it is to stake £10,000 at 1/10, even though both stakes will have the same liability and variance. For this reason – bookmakers apply more markup to longer odds than they do shorter odds.

Another type of biased market could be something as simple as “Fallon Sherrock vs any man”. Fallon Sherrock is a popular female darts player and the crowd love to see her beat her male competition. It is possible that so much recreational money comes in for Fallon that the bookmakers have a lop-sided market and so they price her up with all the markup and anyone she plays may be close to value. The top price on her opposition could very easily be value. Often where the bookmakers price up the exchanges follow.

Biased markets also exist in recreational markets for “an event to happen”. Recreational punters love to bet on events to happen – more so than events not to happen. Markets such as “hole in one in competition”, “147 in competition” or “9 darter in competition” will rarely present value in the “Yes” side but value may be found in the “No”.

A biased market on the exchange can be found when there is a big boosted price at the bookmaker. This may result in more layers than backers in a market which will drive the price up.

The probability of Salah to score may be 0.4 (2.5 decimal odds). A bookmaker may boost Salah to score to 3/1 to attract rectrational money. Arbitrage players may be laying this off at 3.5-3.6 on the exchange. In this instance we have a biased exchange market due to the boost and there is value to be had here. By pricing up markets ourselves and identifying where the boosts are we can take advantage of exchange biased markets.

Steamers

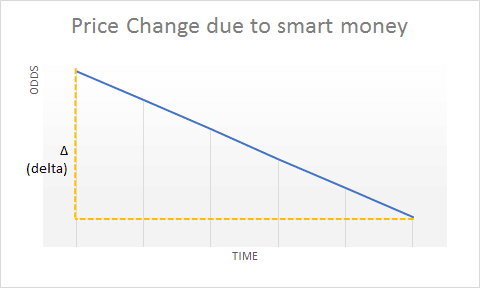

We often see horses and football teams start to rise and fall in price. This is generally because smart money has become aware of “something” – such as inside information on the horse or an injury or new signing in a football team.

We can identify steamers by benchmarking the price of each selection in a market at a point in time and then monitoring the delta price change. Often small changes in price will be random trading fluctuations around the same price – this is just noise. However if the delta price change becomes large enough, we can be confident that the price is steaming in because some smart money somewhere knows something. How far will the price steam in? We don’t know, but if we can bet on steamers at large scale and compound the value of steamers into multiples then we can aim to capture as many steamers as we can. Some will have reached their natural fair price already but we can aim to capture many more before they reach “Closing Line Value”.

Concessions

Concessions can be used to turn negative or neutral equity bets into positive equity bets. Some concessions are worth more value than others. A £5 free bet may not be worth it to the higher staking player. However concessions such as Double-Delight Hat trick Heaven in football or Triple Odds for a Single Winner in Lucky 15s in horse racing can provide significant equity to our betting portfolios.

Getting On

The first time we face a restriction we may consider it as a badge of honour.

The bookmaker has recognised “me” as a threat, that’s pretty cool. I’m not your average recreational punter.

The hundredth time we face a restriction becomes tiresome. There is no point in wasting any unnecessary energy on it. We should recognise that soft bookmakers in the UK have a responsibility to their stakeholders. Logic (and the law) dictates that they must act in their stakeholders best interests first and foremost. It is irrelevant whether we think it is fair or not. We must focus on solving the problem of “how” we get on given this environment.

Many go down the route of betting under other peoples names. I am not going to go down any logistics relating to that in this blog, other than to say it is not an option I currently use. It appears to be getting maintaining this in the long term with Source of Wealth and other documentation changes. I don’t want to risk my future income being hinged on whether I can overcome these unknown hurdles.

Two alternative options are to bet in shops and to bet on exchanges. Both have challenges, however both reward the bettor with the benefit of longevity.

Shop betting can seem logistically difficult to set up. It is best approached through the utilisation of shared resources in a team. Different teams will manage their “runners” with different rules; there may be an equal split amongst all participants, a split by stake, a split by EV or even a direct salary to runners from the head honcho. Shop betting has the benefit of higher stakes, higher EV (as bets are harder to find) and slower restrictions.

Exchange betting requires a demonstration of ability to beat the markets. You are pitting your wits against the liquidity of unknown market makers and you need to be confident that you have an edge. A second consideration is that if you win too much you then need to factor in premium charges. Knowing your limits is critical in exchange betting; you may be able to beat the “to score a hat-trick market” due to the provision of recreational bettors and a lack of liquidity resulting in significant swings in trading prices. However beating the Match Odds market of the Champions League requires a different skillset altogether.

Staking Optimally

We have the ability to review our bet histories to see how different staking methodologies affect our overall ROI.

Sometimes we have no option what to stake. This may be because of low maximum limits or logistical reasons. For example if we are in a shop staking a lucky 15 on four horses it can be hard to compute the optimal stake from different expected values and magnitude of odds across all the permutations of multiples.

It would not be impossible to compute the optimal stake but it would be at the expense of volume and time. Instead it may be preferable to simply stick to a £1 lucky 15 stake on every bet. We’re in and out of the shop in a minute. This is known as “unit loss” staking.

Unit win staking takes the odds magnitude into account; we will stake to win the same liability (e.g. win £500) on every bet.

Kelly staking takes account of the perceived value of each bet and encourages to stake higher on higher value bets.

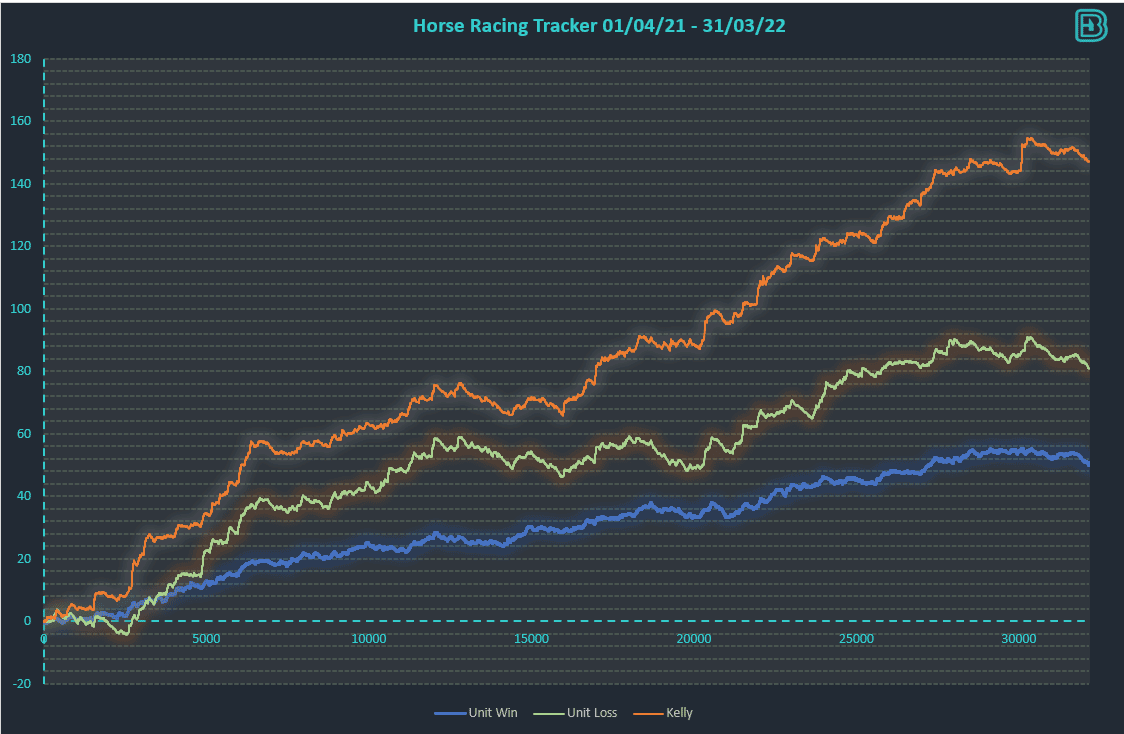

The following graph shows a one year historical review of +EV horses from the horse racing tracker at bookiebashing.net:

We may be able to determine a pattern between the relative difference in long term ROI of the three different staking strategies.

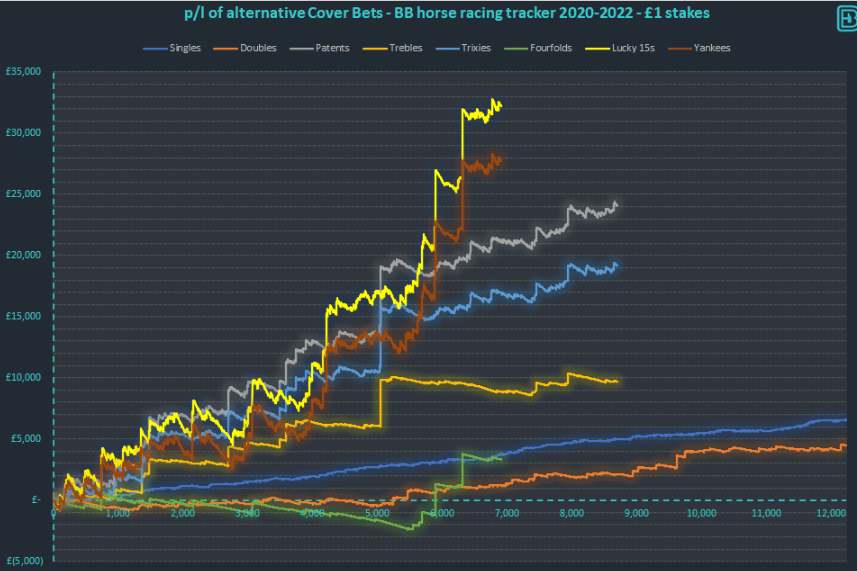

The graph below shows the difference in ROI between different multiples on the same betting history:

Psychological Management

Are you going to do this all yourself?

Good luck.

I’m not sure how many lone wolves have survived in the professional betting environment but it cannot be many. This is because of strong psychological management in professional betting benefits from a support network. Psychological management in betting can be broken down into two separate categories:

(1) how do we surround ourselves with the correct people to carry us through the challenges of professional betting

(2) how do we cope internally when faced with inevitable downswings.

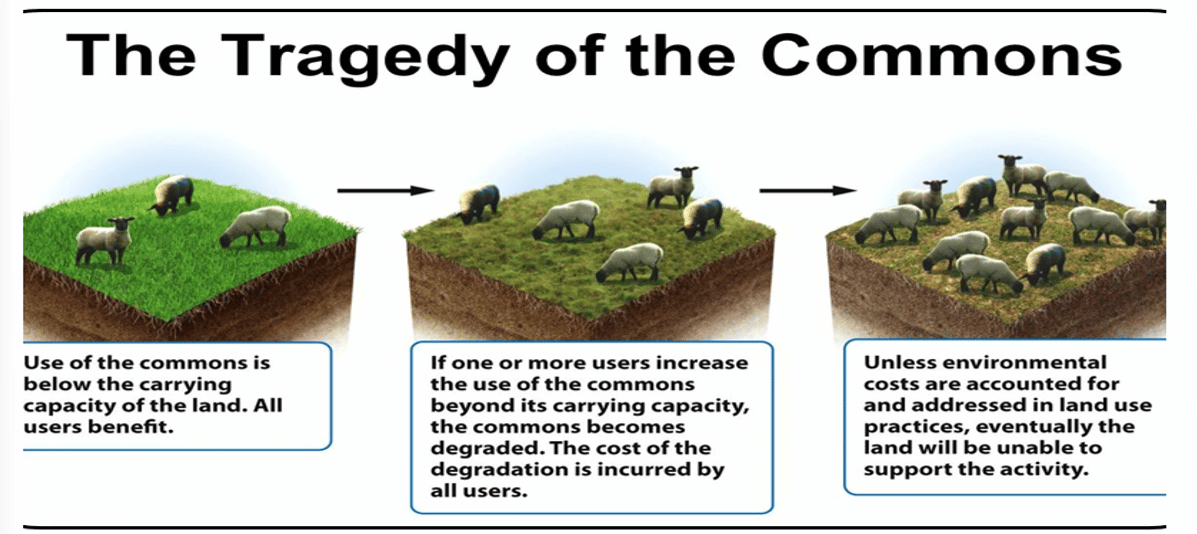

It can be difficult to surround ourselves with the right people. Professional bettors tend not to give away their edges for fear of those edges being ruined. This concept is known as the tragedy of the commons:

Professional bettors are wary of allowing too many people to benefit from the edge that they maintain.

This is a juxtaposition when we consider that it is necessary to surround ourselves with a support network. Betting in teams allows us to share knowledge, skills and strategies with each other. The product of the team is much more than the sum of the individual parts. Also betting in teams has the benefit of getting through downswings. You may be hurting after another loss and your motivation may be at an all time low. But there is always that one guy in the team who is always ready to go again!

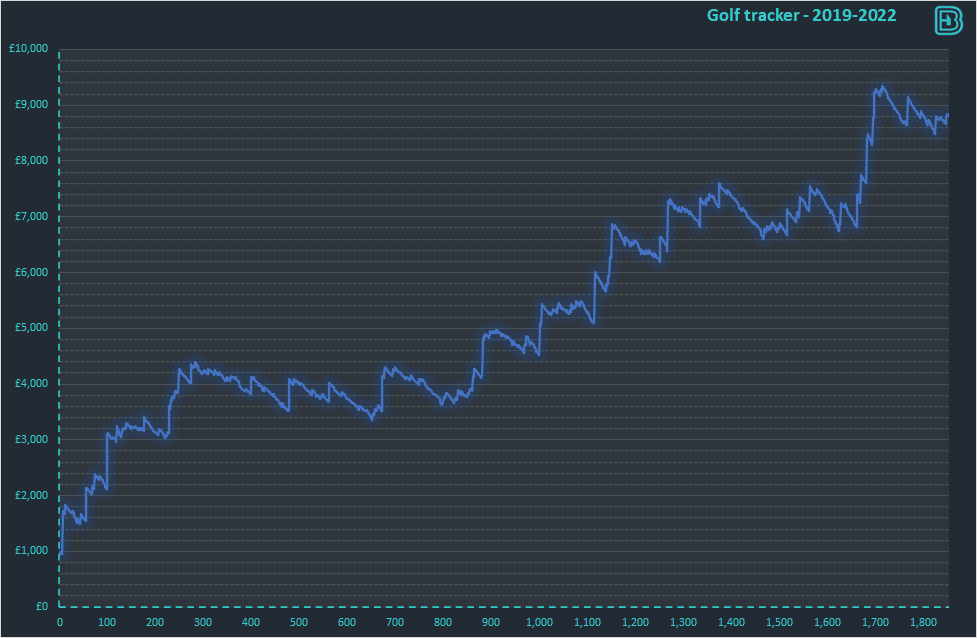

Downswings can be brutal. The following graph show 3-year golf ROI from golf bets published the day before each tournament at bookiebashing.net:

This graph looks quite comfortable however the period of time between bet 300 and bet 700 is around 1 year.

That is a 1 year losing period. 52 weeks of betting and a loss to show at the end. This is not a natural human experience and it requires work to understand the patience required to see this bout of variance through to the upswing.

And this is using a profitable long term strategy. Many professional bettors quit due to the exhaustion of downswings. To protect yourself against this risk always be aware of the potential variance in your betting strategies. When betting under a bankroll understand the risk of ruin.

We can mitigate the risk of ruin by either betting low enough that we are statistically unlikely to go bust. I use multiple bankrolls and bust them frequently. When I bust I reload – perhaps with the same strategy, and perhaps with an altered strategy moving forward.